All organisations need a budget to run smooth, show profits, losses and also show potential where more profit can be made. Treat your budget like this too. It's your domestic economy, make it work.

Just like each country has its own economic system to influence and govern, so do you. You are in charge of your own economy: how it works, where the funds are allocated (to be spent) and how you can continually refine and improve it.

It doesn't take much effort to make your domestic economy work. Just the want to change your habits to get on top of things. You have to be ready! If you have been in denial and not wanting to deal with any money problems, life has probably continued down the same path, your small debts are more than likely growing and now you must do something...

This article could be a good place to start. I'll show you my three elements to making YOUR economy easy. Its the perfect base to get you started.

MY WAKE UP -

I had always followed a very basic budget straight after moving out of home, more of a guide really. I simply made sure I could pay for things as they rolled in.

Growing up, I watched Mum allocate the family money so everything was covered, even when she was going without a wage while starting their own earth moving business. We went without a lot for a few years so I learned how to survive on a low income and appreciate every dollar.

I had a life changing moment though, in more ways than one when my first baby was born. Reality hit... suddenly going from TWO incomes to just ONE was a shock! Things had to get really tight. I was just used to going without if I couldn't afford something I wanted when there was two incomes, how the hell were we going to be able to pay for baby things, let alone the rent, bills, fuel and groceries on one income?

After having three kids, things were just getting scary. I didn't think kids and finances through - I'll admit it. Growing up, you see everyone else do it, so you think it must be ok?? They can't cost THAT much? Can they? Yes, they do. We were using the credit card and it crept up fast.

I finally went back to work when my second born twins were three. I had to. We were paying off a mortgage by then. I needed to go back to work to only cover the mortgage.

After a few years, things were a bit easier and I saw potential for a better life and ended up working up to 6 days a week! Not sure if that's a better life, but it was a start to get our money under control.

...Years later, I am now divorced and paying my own way on my income, some family assistance and a little amount from child support (although this literally only covers the kids grocery costs).

These are the most expensive years and I'm managing to continue to pay off the house, put three kids through High School and go on an overseas holiday every two years.

After getting my budget system working for me, then having to refine it for one income living, I have figured out and want to share the three elements that I live by to make my budget work and flow easily.

3 MAIN ELEMENTS:

1. REPETITIVE INCOME ALLOCATION

This is the main, number one element to your budget. It sounds much better than the word 'budget' and it is exactly what it says: Following a list of places your income will pay for and when it will be paid by.

When your pay comes in, allocate the amounts that need to be paid. ALL of your income should be allocated somewhere. Whether it's for living expenses, small debts, an emergency fund (for piece of mind) or a saving plan.

It needs to be put in it's place to be paid. This is so you don't mix up your pay with savings or bills money. That is a very fast way to lose control of your money again.

If you are self disciplined and can control your extra spending, it really is as simple as following a permanent list of expenses each pay date. Don't be thinking you have no will power, that's an excuse to fail.

Once it becomes a habit, it will only need the occasional tweak when situations change. Keep a check on amounts paid or saved to encourage you to stick to your list (budget).

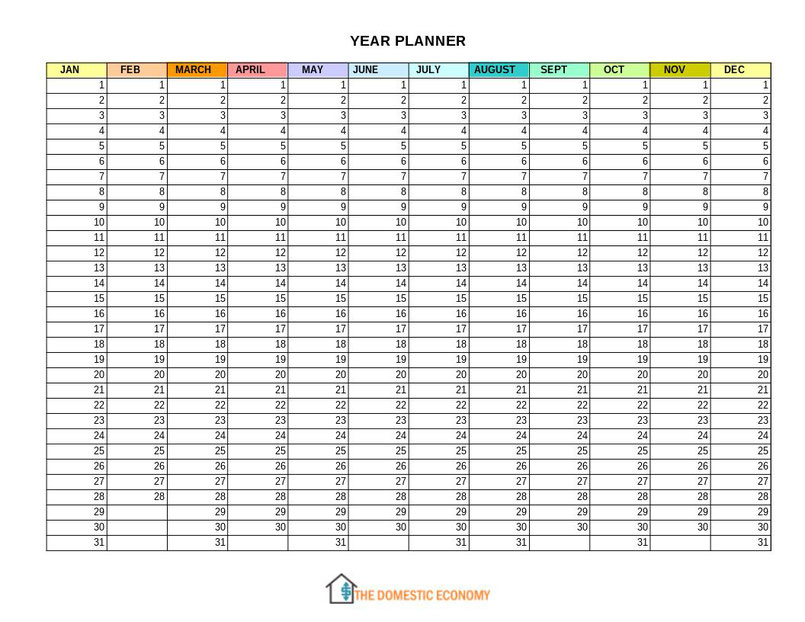

2. SIMPLE YEARLY PLANNERS

I have used these for 10 years and think they are the best budget tool you can use. Extremely handy to keep track of all bills. Print out my PDF yearly planner with every day of the year on it. Going from your last bill from each company, work out when all of the following years bills will fall due. Fill in the planner with all bills due for the new year. Keep it handy so you see it often and you will have no surprise bills come in. Be one step ahead of your finances and ready for the new year and new goals.

Save & Print a free YEAR PLANNER Below.

3. IT'S ALL ABOUT SMALL AMOUNTS AND OFTEN

Finances can be sooo boring, but exciting at the same time. Set yourself small challenges if you're not very self disciplined to begin with. Follow your written budget and keep it somewhere you will always see it.

If you are setting small saving goals within your budget, follow charts/running tally's so you can see the written target at the end. The big reward is at the end of each goal when you get to receive something you've planned for or maybe pay off a small debt and eliminate it from your budget.

By putting away small amounts often you won't miss that money too much and it will add up quietly on the side (or reduce a debt).

When you have to repay debts, the easiest way is to eliminate the smallest debt first while also making minimum repayments on all other debts. Get rid of the first debt by paying as much as you can off it each month. Once the first one is paid in full, the amount you were using to pay off that debt you can then use for the second debt. Keep repeating this until each subsequent debt is eliminated for ever!!!

You'll find pay day even more exciting - Is anything better than pay day? Yes, pay day when you have a plan and are keen to see things paid and savings grow!

It won't take long to hit your goals if you make them an expense in your weekly budget, not an extra. Because once debts are repaid, you know you can afford this amount for savings or investing in your future!

Feel free to leave a comment below.

What do you do to make your money work for you?

Write a comment

Dxn mlm (Tuesday, 19 March 2019 09:09)

We at dxn provide you with the management of your project of natural products of high quality health paid rent and full fees and permits from the competent authorities in 100 countries only joined dxn membership to you registration number 141028845 and carry out your activity with ease