Budget Detox

Does your budget need a good detox?

Sometimes we need to set aside a period of time to achieve a goal and when already following a budget the best solution is to cut costs or permanently reduce them. With a budget detox you will find extra money to do more with.

Most companies rely on us to forget about how much we're paying them and it becomes a comfortable habit. Before we know it, we're paying too much money on expenses and have picked up a few extra over the years.

I recommend a good detox every 2 years. I find this is the amount of time many of my contracts run and after a couple of years I would have lost touch with others needing to check-in and have a good clean out. It causes me to look at ALL of my expenses to see where I'm wasting it and areas I might be able to save.

I don't rush the process either, sometimes taking 6 months to get through my list depending on my time and my due dates of bills paid.

Want to rid your budget of any toxins to find more money?

Join me as I go through my variable expenses to cut costs in my budget with weekly updates added to this page. When finished it will create a big resource to use any time your finances are ready for a budget detox.

Your Budget

Budgets are made up of many parts and expenses but all of them belong in one of two categories; fixed expenses and variable expenses.

When having a budget detox or creating one from scratch it's important to start with these two categories to file expenses to

1. Determine the frequency of payment required

2. Prioritise the payment

3. Find it's amount

Lets look at what both categories are first.

FIXED EXPENSES

This category is the easiest of your budget to control because it's made up of expenses we pay every time we are paid.

They are regular and of a fixed amount or similar cost each time they're paid.

By paying these regularly, they allow us to continue to function on a daily basis.

We always seem to make sure there is enough money for these as we know they will be paid again once we are.

As we all live different lives, these costs might slightly differ for every household but generally fixed expenses are made up of;

RENT/MORTGAGE

GROCERIES

FUEL/TRANSPORT

PERSONAL SPENDING

(HOUSEHOLD GOALS - paying off debt & saving/investing)

VARIABLE EXPENSES

This category can be hard to control because it's made up of other irregular expenses.

Basically, all other expenses in our life that are not paid every time we are but due monthly, quarterly or yearly.

It can be a huge category based on both other needs and wants that we pay for.

A category of sub-categories. Confusing? I know. This is why many people avoid creating their budget to begin with.

An area we can be unprepared for because they're not due regularly causing budgeting chaos and out of control spending.

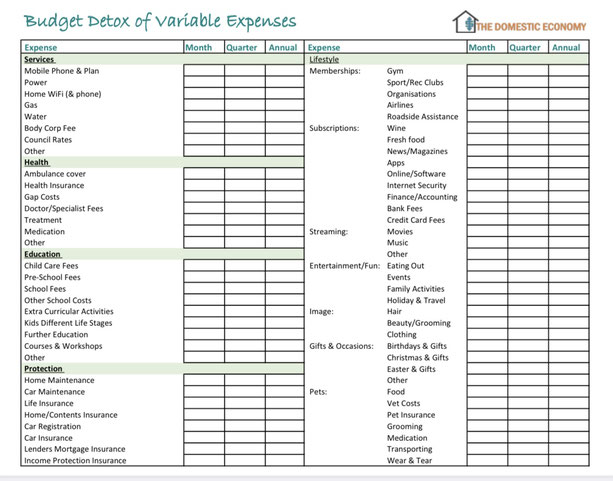

Again, as we have different lives our variable expenses will be different but can be broken down into its own sub-categories of

SERVICES

HEALTH

EDUCATION

PROTECTION

LIFESTYLE

Create your 2 lists

FIXED EXPENSES

Write down a list of all of your weekly or fortnightly expenses you pay each time you are paid, without fail.

VARIABLE EXPENSES

Write down a list of all other expenses due at other times, monthly, quarterly or yearly. Include the amounts you're currently paying so you're able to compare the savings you make during your budget detox.

Download to fill in or print the list below as a guide for your variable expenses. Add all other costs you will have throughout the year.

Start your budget detox

*Dual incomes and couples, you will have the best outcome when performed together so you're both on the same page and working towards the same household goals together.

Once you've created your list of variable expenses, re-order these from most required needs to least wanted. Most required would include things like power and water because we absolutely need these to function. All other variable expenses are choices that we need to make for our own household and lives.

The bottom of your list is where you might be able to get rid of some all together. Maybe you have subscriptions you've been paying for but not getting use or value from? Other savings can be made in your list where you think you'll be able to cut costs or find a way to make it more affordable by intentionally causing the expense to go down.

*A NOTE ON BEING INTENTIONAL

Being mindful about your expenses will cause intentional savings because we cannot change anything until we're aware of our situation and can see the overall picture. The biggest savings can be made when we're intentionally looking for it.

Often, our lifestyle (wants) becomes one with our needs and this can cause budget leaks. Lifestyle choices are great and encouraged but not at the detriment of your needs. It is the #1 cause of budget failure and use of credit cards. The solution is to ask ourselves if we need or want the cost by finding its value for your household. By finding the answer we're able to arrange our list in order of priority.

From here we can then easily detox our budget the way we need to by either cutting out or cutting back where we can, want or need to.

Prioritising your expenses will cause you to become intentional.

We're all set to start...

Services

1. Mobile Phone Contract

Our phones have become our filing system. They're a watch, calculator, navigator, diary, pc, work, social connections and the list goes on. Even though this expenses is a want, I have started with this one because I do get value and use from this expense but it's also where I make my biggest saving. Here I get to cut the monthly cost and update my phone. Winning!

I've never owned the very latest model, preferring to be one or two models behind because of the price difference. Over the years of owning an iPhone I have noticed the general release month of the new phones happens around September/October each year and this is a perfect time to take advantage of the reduced prices for the previous models. Sometimes if happy with my current phone after the 24 month plan has ended I just change the data plan to a lower cost. When I do this I can make big savings until I need to update my phone but this year I will update my current phone and lower my plan... as soon as the new model is released any month now.

2 years ago I stupidly updated my phone because I was heading overseas and thought I needed the updated camera to take photos for my travel website See Cook Islands. Even after being told by someone in the Optus store to wait 2 weeks for the new model to come out to save more, desperation and stupidity kicked in and I updated it signing up for $109 a month for 24 months. I've regretted it ever since. My contracted plan ends this week but I will be waiting for the new release to update my phone to the model right in between. No more $109 expense for this each month as the release is expected in September, just wait a few more weeks Kylie.

No more regrets just savings.

Next month I hope to reduce this cost to under $80 per month instead of $109.

Savings per month $30>

WHAT TO DO.

- When does your current mobile phone plan end? Find out now to see if you're eligible to save money here.

- Next, if outside the current contract timeframe check your phone company's monthly phone deals. Check their current monthly call/data plans as well.

- Can you find the right phone and/or plan to cut your monthly expense here? If you're not able to do this yet, mark the date on the calendar when you can so you can come back to this expense.

- Even when not updating your phone it's your responsibility to change your call/data plan at the end of your contract or you'll continue to pay for your 2 year old plan when you could be paying less. It's just wasted money.

2. Power/Electricity

This is one of the expenses under the '4 walls' of household needs (food, housing, power/water and transport) that we must cover in our budget. Electricity usage is the most expensive household need in our variable expenses and checking in on this cost is beneficial because you might be able to lower your costs, increasing savings by paying your bills on time, or being offered a better deal for being a loyal customer.

Comparing your power company to others will give you an idea of how much you could lower your bill.

When we make savings on our power bill we're not only saving money but helping the environment when we consciously use less electricity.

Call your power company this week to have a chat.

I am still happy with my current power company because I receive a massive 46% discount when I pay my monthly bill before the due date.

WHAT TO DO.

- Find out from your power company if they're able to save you money to remain a loyal customer ;)

- Find ways to cut back on power consumption in the home and be intentional with your usage.

- Turn appliances off at the wall when not in use to stop wasting power (saves up to 10% per bill)

- Financial incentives are available until 2030 for solar power rebates. If you've been thinking about installing these to your home to create your own power and savings, check here to see if your state is offering this rebate.

- Upgrade your hot water system to a more efficient solar or heat pump system with help through the government Solar and heat pump hot water system rebate I took part in this Government scheme over 10 years ago. I can highly recommend the heat pump systems, they're fantastic and I noticed a definite saving of approx. $80 each quarterly bill. Click here to see if it's available in your state and if you're eligible.

Read my article 10 or more ways to lower your electricity bill

3. Home Phone &/or Wi-Fi

This expense can be forgotten. We habitually pay this or have it set up as a direct debit for years before realising there's a chance to save money. There are a few elements to this cost which gives you more than one option to save or just get more for what you're currently paying.

It can be one service or a few, made up of your home phone, Wi-Fi and maybe your mobile phone charges too if you have them all bundled into one contract. Is your home phone not used or needed anymore? Many people are disconnecting their home phone because they prefer to use their mobile phone instead. Eliminating this would instantly save you money monthly.

Wi-Fi can be charged for the Mbps (speed) and the data usage required for your home. Some companies will change your contract if you're not currently locked in and offer you a different contract either keeping the same cost to get more data per month and a higher speed or cutting costs because you're able to cut back on usage.

Last week I called iiNet, my internet & home phone provider to check-in. I was in a 'no lock-in' contract and was able to find a better price! I was given the option of paying $69.99 a month for higher Mbps with the same 500gb or continue receiving the same Mbps/data usage and pay $59.99 a month. Our household of 3 adult kids & myself seem to be happy with our usage, as I don't hear complaining so I decided to lower my monthly cost.

I was able to lower my monthly payment of $71.48 to $59.99 for a saving of $11.49 a month!

WHAT TO DO.

- Check with your supplier to find out if you're locked into your current contract? If you've been paying the same amount for more than 2 years there's a good chance you're not locked in and can save money.

- Call your home phone and internet provider and ask them if you're able to lower your monthly contract cost. Discuss all of your needs.

- Find contract options and compare costs. We're almost always able to save money on this expense every couple of years.

4. Gas Supply

If you have supply company options, it gives us 3 choices to lower this expense. As with our electricity, we can either cut back usage, ask for a better price or shop around. It's one of those 'supply & demand' expenses so we must be intentional to change the monthly cost.

My house was built before natural gas was connected to my rural town therefore only require this for cooking, using only one 45kg cylinder every 2 years... I'm pretty sure I pay more for yearly cylinder rental than actual gas but that's ok. With no other choice of suppliers, I will continue to pay the same cost for this expense each year.

My cylinder rental and gas cost is an average of only $!50 each year.

WHAT TO DO

- Lower your usage where you can; close doors if you depend on gas for heating. Shorten shower times, especially if you have a large family and use a gas for water.

- Call your gas supplier to see if there's any way you can lower your costs (can only ask)

- Call around or look online for another supplier in your local area and compare costs/fees and change companies.

5. Water Supply

This cost is an actual 'need' and it comes under one of the first 4 household basic needs. We can all do something to save on water usage though because this resource effects more than our money, it effects life on earth.

The cost for this service is not competitive because we generally have only three supply options:

Our local water authority who controls the system that services our needs.

Direct rain catchment into private tanks and dams, or

Water cartage supplier to deliver water needs.

Therefore, the only way to reduce our cost is to reduce our usage.

Our mindset alone has the ability to change our habits here by understanding and appreciating the source of our precious resource. Knowing our need for water automatically helps us be mindful when turning on a tap. This is noticeable on properties relying on tank water for their needs. When it doesn't rain, they need to pay for water delivery, keeping them mindful and aware of their usage and they know exactly how many litres they use and might need (to pay for).

This proves when we're aware, we care.

I rely on town water supply so need to watch my usage. I have 2 small tanks catching rain from my pergola and 1 small tank catching rain from the kids old cubby roof for garden use. A water filter on my kitchen sink allows us to drink the disgusting sterilised water that is supplied to our town instead of buying it in plastic bottles. And after many years of trial and error in the garden I've finally learned a few tricks with location planting using sun, shade and other plants to lower watering needs.

WHAT TO DO

- Reduce costs by refining our needs to use less

- Be mindful; water provides life to all on the planet

- Reducing shower times

- Using the half flush on the toilet

- Recycle 'grey' water from your washing machine and bath where you can

- Use a dishwasher, it uses less than us.

- Buy water appliances that have a great water saving rating

- Plant your garden to create mini self sufficient eco systems requiring less water

- Put trays under pot plants to conserve water run off

- Catch rain where you can

6. Body Corporate Fees

When owning a property where there are multiple dwellings like units, townhouses and more than one owner is involved will include some sort of body corporate arrangement and expense.

They're an extra cost to owners of these dwellings but a necessary one, put in place to manage and maintain the function of buildings and gardens or to look after any common areas and facilities shared by owners and residents. Building insurance may also be included in the body corp. fees but generally cover all costs involved with maintaining and running of the property.

If you rent, the owner of the home is responsible for this fee but may include it within your annual rent to cover this cost.

WHAT TO DO

Before buying into property which has multiple dwellings,

- find out all costs involved with the fee and what it exactly covers to factor into your overall housing cost.

- Find out the cost of late payment fees to be mindful of paying on time and avoid another cost

- To fully understand fees, the budget used and management of the property, attend meetings to listen or contribute.

7. Council Rates

Another necessary extra cost of owning a property that we must include in our annual household bills budget.

These 'rates' are set by our local governing councils to cover the costs of service, maintenance, building and repairs to our local shires and their common areas. I guess you could say they're similar to a body corporate but are governing a wider zone to provide infrastructure and maintain the functioning of multiple communities. The costs are based on the size, population (contributing properties) and council requirements to undertake all involved so we can't really save on this cost, unless we move to a less populated area.

WHAT TO DO

- Choose the easiest payment method for your budget, whether that is one lump sum each year or broken into four quarterly payments

- Budget for it by being aware of when this expenses is due so you don't fall behind in payments especially if paying quarterly

- Write the due dates on your year planner to be ready.

Health

1. Ambulance Cover

Ambulance cover is our #1 health priority cost in the budget.

This expense protects us against the cost of treatment and transport to hospital if we need emergency medical attention. It's a form of personal insurance because if we don't have this cover, we run the risk of having to pay upwards of $1000 for the privilege of using the service.

Cover starts at $49.08 for singles and only $98.15 to cover the family each year.

Australian's holding certain concession cards are entitled to free clinically necessary ambulance coverage throughout Australia. If you have a pension card or health care card, check you are definitely covered before relying on the belief that all who hold one are covered for free.

WHAT TO DO

- Make sure you have cover and know the annual due date (write it on your year planner)

- Join today if not a member!

- Teach your kids the importance of this cover and to join as soon as they turn 18

2. Private Health Insurance

We only need to cover areas that would leave us out of pocket or cost us unnecessarily therefore making sure you have the right cover and if we require it at all is important.

Health funds make some people believe it is a necessary cost and other people avoid it, where they could have utilised it to cut costs. It really depends on the individual or family needs as to whether you should have private health insurance though.

While it may benefit a person spending a lot on their health, we only need it when we need it. Don't let family, the government or insurance companies pressure you into joining as soon as you become an adult scaring us with additional costs if we don't join while young. Sometimes we don't need it at all if we can comfortably pay for our health needs. Paying without benefit could actually cost you more in the long run. You can do this when you're health needs are becoming costly and going to need more attention. No one else should influence your decision to protect your finances, this cost is personal.

I used my facts to determine the cost of this cover and while myself and my kids were young I chose not to have private health insurance. None of us needed to spend money in any health service areas. The little we did like dental, I paid cash from my own 'dental fund'. This was a different story though when I turned 40. I was still very healthy but knew the things that would probably start needing attention and spending on things like my eyesight, teeth and body so I chose to join and only cover these three areas for a reasonable cost amount. I know If I need a hospital that I'm ok going to a public hospital therefore don't need cover in this area. Covering my needs of only dental, osteo and optical, I've been able to keep this cost to $30 per month.

WHAT TO DO

- Compare the costs through some different health insurance companies looking at cover for only your needs, not wasted extras you won't get any benefit from

- Compare the cost of family cover per month to two single policies instead for you and your partner. If you have healthy children you might not need to cover their health costs and pay for them instead

- In a nutshell, choose the cover that's right for only you and your family

3. Gap Costs

4. Doctor/Specialist Fees

5. Treatment Costs

6. On-Going Medication

Education

* I WILL BE ADDING TO THIS PAGE AS WE GO THROUGH OUR EXPENSE LISTS, ONE AT AT TIME.

CHECK BACK REGULARLY OR FOLLOW FOR ADDITIONAL UPDATES ON FACEBOOK.

© Copyright 2025 The Domestic Economy