What you allow is what will continue, so stop allowing your money to be given away.

If your current income is just not enough and your expenses are adding up to more than you earn, it’s time to cut out or just cut back on some unnecessary costs of bills to save thousands each year.

You are in complete control of your money and what it can do for you. Be empowered to take control, of all spending and expenses in your life and cut down all of them. It’s not hard, it only requires a little bit of time now to sit back with more money to use in other places.

Most people keep paying their bills each month, quarter or year as prices rise. Some don’t even realise there are savings to be made in each area.

Write your list and go through each expense to tighten up and save. Check if any spending can be cut anywhere in your budget starting with the weekly expenses or what you pay every time you receive your income.

I like to separate all my expenses into 2 categories, ‘weekly’ and ‘yearly’. This makes it easier to go through by having 2 lists to eliminate wasted money instead of one massive list…not as daunting. Next look at all of the bills you pay less often; monthly, quarterly and yearly expenses you have throughout one year.

‘Urgh, too hard’ you say? I know this would stop a lot of people so go through lists one at a time over a few weeks if you think there's too much to do.

If having trouble with any of this, just remember my psychological sum;

$20 each week for 1 year = $1,040

By reducing only 4 of your expenses by $5 each, you can save $1,040 per year! This can help cover other existing or new expenses.

*Find other companies willing to charge you less for what you get.

*Search online in your own time, for the best company for each expense, including retail items you may need to buy.

*Change companies so your bills and premiums are cheaper (although don’t compromise the service or inclusions you will get).

Cutting back your expenses is only up to you. It all depends how much you need to cut back as to how much you will cut back.

Don't be lazy and let high expenses continue. If you keep putting it off, you will continue to let your finances be out of control and this just makes your life harder.

OVERSPENDING SOLUTION SO YOU

CAN PAY LESS TO SAVE MORE =

Aim to reduce every expense by just $5 each.

SO EASY AND ACHIEVABLE !

Some costs are impossible to cut back on but others CAN be reduced in some way or another.

I'll separate all example expenses into 2 categories, ‘Weekly’ and ‘Yearly’.

CUT BACK ON WEEKLY EXPENSES

1. HOME LOAN OR RENT

Let’s start with your most expensive living cost. This should be no more than 30% of your total income. Any more than this and you’re paying too much for where you live.

We would all love to live somewhere nice but you have to go where your money allows. Housing costs are almost out of reach and this is where your biggest savings can be made by living in areas and housing within your reach.

Is there a way of making your rent or mortgage less each week?

Refinance your home loan with the intention to save on interest and broker fees. You don’t want to give your money away in fees when you could be paying more off the capital and less interest paying it off sooner.

If you live in a rented home, can you move to a different home or area to save on rent? Is it worth traveling further to work and spend more on fuel to save on rent? Weigh it all up. What ever you do, remember saving just $20 a week equals $1,040 each year.

If you’re able to lower rent from $450 a week to $400, that’s a saving of $2,600 a year.

2. CAR LOAN

Similar to a home loan, your car loan can be refinanced to a better loan for savings. Look for better interest rates and if you can afford it, pay off more to reduce the loan faster to have one less debt

and not reqire this expense at all.

Do you even need your car or the second car in the household? If you live near public transport and this is all you need, sell your car and pay as you go for transport. If you live no where there is public transport

available, buy an older and cheaper car. You don’t need the latest car to drive here and there, anything will do to save money. Borrow $10,000 instead of $20,000 to really cut back repayments.

3. GROCERIES

Grocery costs can also be up to 30% of your income, so cheap meals are a great way to save here. By planning a little and only buying what you need in advance, it’s easy to save on this expense.

Try to only buy your groceries once each pay cycle and allocate a certain amount to stick to. You will save money this way, rather than smaller amounts often during the week. This can add up to far more than a weekly amount.

Buy in bulk where you can and cook in bulk to freeze meals, saving it for a night off from cooking.

Grow your own veges to cut costs of groceries. Grow only the food your family eats and make a lot of meals using the seasonal produce you grow.

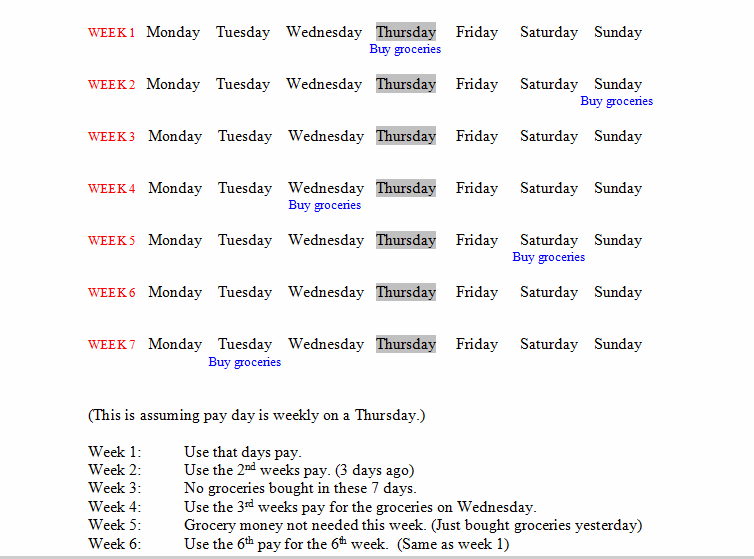

My favourite trick is to stretch out my grocery days so they eventually overlap giving me a double amount for groceries approximately once every 4 or 5 weeks. It might be a hassle to change the days you shop but if you can it will be worth it.

This requires using more staple foods to stretch out the days between. Make cheaper meals with rice or pasta so you don’t just spend more each time you buy groceries or this would defeat the purpose. Think of some other cheap meals to fill in the extra days.

You can see in week 4 and 5, the grocery amount has over lapped and you get to keep that weeks amount for something else.

4. FUEL

This can be a difficult expense to cut. Make sure you fill your car only on early weekdays. Petrol stations put their prices up when the weekend or holidays are approaching.

As I mentioned in the car loan solution, can you sell your car and use public transport? Can you share the driving with someone else so you both save?

5. WEEKLY SPENDING MONEY

If you don’t include this in your budget, you should definitely add it in. By paying yourself first, you will save money in the long run. You will have cash in your wallet to use if you need to and you won’t dip into other money if you do need to buy something unexpectedly.

Allow yourself an amount that is reasonable and you can afford.

6. BABY GOODS

Do you really need all of those baby things? Your parents probably didn’t have all of the crazy extras people ‘want’ for their babies.

If I was to do it all again knowing what I know now, I probably would have not bothered with a bassinette and gone straight to a cot. I wouldn’t have bought so many baby outfits because that $50 I spent often on new clothes for baby, they outgrew within a month and I realised I could have got by with about 5 or 6 outfits only for each growth stage.

They don’t need many toys either. A few to educate and keep them entertained at each stage is fine.

Buy secondhand baby furniture and sell when no longer needed. Paint them to match your décor instead of getting expensive new items.

Look online to see if there are any discount nappy outlets in your area. I purchased my nappies from one of these and saved 50% on nappies every week. Who want’s to pay full price for something that just catches poo

There’s no point buying expensive baby items if you need to pay the mortgage first. Oh, the money you can save by not needing ‘stuff’.

7. ENTERTAINMENT

Keep entertainment costs down by being conscious of this cost and doing different things that cost less.

It shocks me that some people spend a fortune on entertainment but are struggling in other areas. If you can't afford to go out, don't. Sometimes you just have to go without, even if just for a while. Try and view the expensive outings as a treat.

Replace the costly activities with short road trips, nature walks and picnics, Things like mini golf or the movies are good entertainment if you must get out. Make even cheaper and take your own snacks you’ve already paid for.

Cut back on nights eating out or drinking. You’ll spend less on alcohol and feel better for it. Maybe catch up with friends at home instead over a bottle of wine.

Get online and source the free or cheap entertainment in your area.

Spend more time on your hobbies and interests, especially if they can make you money! Stay home more, you’re paying too much for housing, you may as well enjoy time there.

8. EATING OUT, TAKE AWAY FOOD AND COFFEE

As with entertainment, keep this expense to a minimum. It’s probably the easiest thing to cut back on in your budget as you can eat at home more often if you have to. This is more of a luxury expense.

Cut back on this ridiculous cost. If you pay for eating out often, try to cut it back by at least half and prepare more meals from ingredients you have already bought. Just by cutting out one restaurant meal each week, you can save at least $1,000 a year, per person.

Coffee is a daily treat for some but this little expense often, will add up very fast without you even realising. Just 5 cups each week at $4.50 a cup will add up to $1,174 in 1 year.

Using the above expenses as an example and assuming you can manage to save just $5 minimum on each of the above weekly expenses (all 8), you will be saving $2,080 a year!

CUT BACK ON YEARLY EXPENSES

9. CREDIT CARD REPAYMENTS

How much is your annual card fee? Are those fees too high? If so, find another card offering less fees and interest charges. What ever you can benefit from because it’s all about what you can USE each company for. How can you get the most out of a credit card?

Take advantage of credit card companies and take up their offers of interest free periods. The best are for 12 months or more. You need to take the 12 month option to be able to get the balance down while not spending anything to achieve a $0 balance easily. Chip away at it over the year but be sure to pay it off during the interest free period to use it as an interest free loan only. When it is fully repaid, move to another card with options to suit a debt free you.

Some cards even offer a free domestic flight each year or massive amounts of frequent flyer points. Use these companies for your lifestyle.

I was able to pay off my $3000 credit card debt, interest free over 15 months repaying only $200 a month ($50 a week) and received 75,000 Velocity frequent flyer points which I am using for flights this year. Perfect!

10. BANK ACCOUNT FEES

Keep an eye on how much the bank is taking in transaction fees and change accounts if you are able to save on these. Choose accounts that don’t charge excessive amounts to use them. They are only holding your money after all, not performing miracles or giving much interest back to you so don’t give it away to them.

11. CAR COSTS

Car loan repayments, regular services, fuel, insurance and registration can add up.

My car costs add up to around $9,800 each year for 1 car! That is so ridiculous when you think of how much we give away each year to just function in society! Thinking this way can put you in a better mindset about your money though.

There’s only one way to eliminate this expense from your budget and that is to sell your car or to buy an older, cheaper car.

Weigh up all of its purchase, running and maintenance costs to see if you're better off without it.

It’s amazing what you can do without if you have access to other transport.

12. MEDICAL, HEALTH INSURANCE & DENTAL

Private health insurance can cost a lot and even be out of reach for a family, costing more than $120 a month! While I think private health is beneficial for every adult, I don’t think this cost is required for healthy children not needing to get benefit from. If your kids are well, have healthy teeth and good eye sight, I think you should only need singles cover for the adults. You are the one who is more likely to need glasses, dental work or more specific treatment like Osteo as you get older. Let your kids get their own cover when 18 and once they feel the need to start using the benefit from private health insurance.

I have single extra’s cover. I have no need for hospital cover as I’m willing to be treated by any doctor on duty. I don’t need to choose my Doctor, especially for an emergency. Any one will treat me under those circumstances so I don’t mind going to public hospital as it is totally free.

Weigh up your needs.

Another way to cover these costs is to put an amount aside each week into your own medical fund. Stash an amount ($20 each pay) to have about $1,000 per year and use this when needed.

A first for Australia though, is a company called smile.com.au is there for us now. By joining as a family or single for under $99 you can have dental treatment with no waiting periods and unlimited use with discounts between 10%-40% off all dental treatment. If you already hold private health cover for dental, you can benefit twice using smile and your health insurance!

13. ALL OTHER INSURANCES

Change companies if the premiums are rising each year. Find a policy that will cover exactly what you need it to. Make sure you don’t under estimate your level of cover. There’s no point having insurance if you’re not covered for things that matter to you.

Some companies offer multi policy discounts so if you find a company that can better your car insurance, see what they will offer you for Home and contents insurance as well.

All insurance companies can be found online, so comparing prices is easy, from home when it suits you.

If looking for a better personal insurance such as Life, Income protection, Total and permanent disability or Trauma insurance, compare these prices through www.cashbackclub.com.au They will share with you, half of all broker fees charged on your policies every single year saving you even more.

14. ELECTRICITY, GAS & WATER

As with most companies providing a resource and service to your home, there will be a different one who can lower your living costs.

For general savings, I think you just have to be conscious of usage costs and do what you can to lower the usage in your home.

Turn off all appliance power points at the wall when not in use I have proved this to be true with my electricity bill, although people think I’m weird turning off my kettle & toaster at the wall too but it actually saves you a lot. My electricity bill has never been above $600 a quarter for a family of 5 with daily clothes dryer use.

Only use heating, cooling, lights and water if you really have to and install water tanks to catch free water and redirect grey water for garden use.

15. TELEPHONE, MOBILE AND INTERNET

At least we have a huge choice from all of the network providers out there. With so many to choose from, I’m sure you can find a better deal for a cheaper cost.

Find out what each company can give you for less money and change over. It’s not that hard to save on telecommunications as one company can provide all of these services.

16. CHILDCARE, PRE-SCHOOL & SCHOOL FEES

Kinder and school fees are unavoidable.

Putting your child in childcare is a matter of choice. If you hold a concession card, fees work out to be much cheaper with the government subsidy.

Families need to justify whether or not they are better off financially. Is it worth earning a wage to spend half of it on childcare? Can you work from home instead?

Can grandparents mind the kids on some days? This may be impossible now as most grandparents are working too.

People really need to decide if they can afford to have kids now. I think the old days of traditional conditioning to ‘have a family’ from our parents are over. Society has changed and you really need to understand the reality of how much money kids actually cost over the years.

Our lovely little creatures can cost more than half of our income over their 18 years. Clothing, food, education, health and extra costs are constant. Just when you think you’re on top of things, you need more money for them.

Make that decision based on what you want in life because there is not much cost cutting in this department, only to think/buy smart and not give them everything they want to cut any little costs you can.

17. CLOTHING & HOME DECOR

We all like to buy new clothes and items for home but do you really need to buy half a new wardrobe with each season change and fit out the house with new cushions, lamps and bed linen often?

Change your shopping habit to be a smarter shopper. Check out the clearance items first. I always find those essential items that don’t really date much for $5-$10 each and only throw in those extra items when I need them.

Don’t buy too many items that will be out of fashion in 6 months. It’s like throwing your money away as you will never get your money back on clothes. Better still, just stay away from the shops and fill your life with more meaningful things.

18. PETS

Pets can cost a lot of money. From attention, to taking care of them, even vet bills when needed. Unless you allocate some money each week for this expense, you will more than likely be out of pocket at some point in their life.

Pets don’t realise what they do and sometimes damage things that need to be replaced. Train your animals from an early age to not poop everywhere, chew things or destroy furniture and carpet. If they continue this behaviour, they can cost you thousands in replacements and repairs.

19. PAYING FOR TV/MOVIES

Cut back here by getting rid of any Foxtel or similar Pay TV subscriptions. These prices are over the top considering you can probably get more viewing from Netflix or similar now.

Netflix basic membership is under $10 per month. They give you movies and TV series on demand, not expensive repetitive viewing, at the wrong time. Don’t let them suck you in with choices that aren’t really available when you are.

20. ALWAYS WATCH YOUR INCOME AND EXPENSES

The best deterrent to spending money!

If you watch your balances, incomes and expenses often, you will know exactly how pretty your finances are sitting and know what you can and can’t afford, now and in the future.

Plan ahead for ALL expenses and prioritise these. You should pay yourself and all creditors first, then any bills before you can reward yourself with extras like clothing and entertainment.

It’s amazing what you can do with a bit of pre planning. Allocate all money to see what is left over and put that to good use. After a while you get to reward yourself. You will appreciate money a whole lot more than you were before.

Write a comment

Kerryn Gambino (Friday, 13 April 2018 21:39)

Can’t wait to read more Kylie. Your Mum mentioned a ebook, I’d be interested in purchasing. Well done!