Can't track your spending?

Tell it what to do by using a simple cash file system.

A common way to handle money is to not handle it at all:

+ Income is deposited into your bank account.

- The most important expenses are covered or set on auto, taken from your account leaving the rest to be spent the way you want using a debit or credit card.

= You run out of money and wonder where on earth it all went and wait until the next pay day.

Sound familiar?

It’s more than likely because you’re not actually handling it, touching it, handing over amounts you've saved. By spending money freely with debit and credit cards at the point of sale, we dismiss not only other goals and wants but we dismiss the pain we’re supposed to feel when parting with money for goods and services especially outside of our household budget.

People are using cards more and cash less because they choose the easiest way to pay for things but this is the easiest way to overspend and live pay-to-pay instead of in abundance. Using cards to pay for things, we’re more likely to overspend as we’re able to have a YOLO attitude when we can’t see or feel what we spend.

Handling cash (or money saved) to buy things is the best way to control spending because it’s allocated spending, not a ‘free for all’ approach.

The only way to stop random spending is to make sure all needs are covered as well as your wants and goals in a controlled way.

WHY SHOULD WE USE CASH TO CURB OUR SPENDING?

When paying for something using cash, we hand over the money we’ve worked hard for. We can see it leave our hands as an exchange takes place:

Hand over cash,

take your goods and leave with less money feeling the emotion of now having less money.

We feel the transaction and know we lost money to do so.

Many people think using cards is an easy way to manage their money but It’s a completely different feel when paying for goods by scanning a card. It doesn’t feel like we’ve spent money at all. We miss out on feeling the transaction. Scanning a card is all too easy and we feel better when we spend our money this way because we don’t want to see the give and take of the sale. We instead get to leave the shop with the products AND we get to put our card back in our wallet! It feels like a win-win situation but it will do more damage to your finances over time.

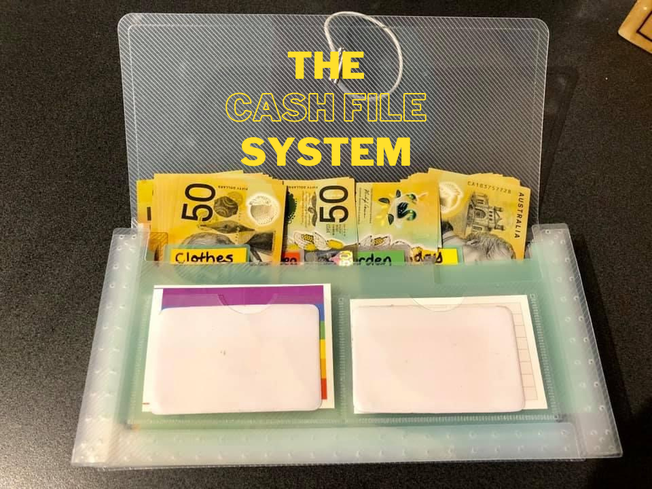

Using cash for spending where possible, gives you full control of your money. Yes, it might take a little more organising and planning but it will actually give you more money to spend and a great way to do this is to use a cash file system.

WHAT IS THE CASH FILE SYSTEM?

You might have heard of the cash envelopes or cash jars but I like to call it my cash file because it just needs to be filed where it’s needed. It allows me to spend money on what I want and to work towards goals.

Each pay I withdraw an allocated amount of cash to split up and ‘file’ between the areas I want to spend money. I use this system for all of my wants outside of my general household expenses. Spending on wants without having the money will ruin my finances but using this system I can cover my costs of living AND get what I want!

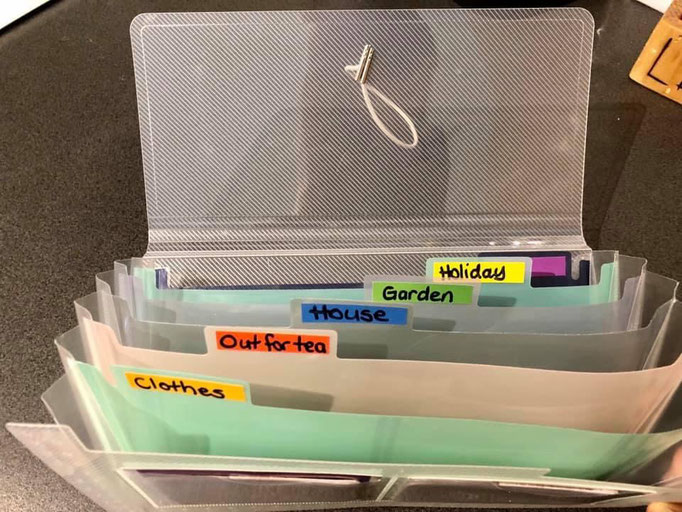

I’ll use my cash file as an example.

I follow a budget that always covers the 4 main areas of need and monitor the payments from my bank accounts.

These are.

Housing

Food

Utility Bills

Transport/Car

For everything else, I use cash. These change over time but I currently have 6 areas in my cash file. They are,

Eating out

Clothes

House

Garden

Holiday

Kids passports and 18th birthday

By adding to these areas each pay I’m able to determine the amount for each category depending on which is more of a priority. There is no chance of overspending using this system because if it’s not there, I can’t spend it yet. It helps me avoid debt and spending money where it could have been used for something else more important or fun.

Spending more money than you have for something will put you back financially and it’s the most common way to run out of income and rely on debt. Would you rather spend your money on random purchases each week or put it towards something you really want to achieve?

If you find you’re always over spending on any expense, add that section to your cash file system to monitor. It’s a disciplined approach to curb over spending. Being intentional with your money will give you more as you spend differently when you only have a certain amount.

This system goes back to basics and teaches us about self-discipline while delaying gratification to get more satisfying things in life. It’s a great way to teach kids about the system of money too before they start swinging a card around! Teach them how to spend money by covering their wants until they’re independent and will have learned how to also be responsible for their adult needs.

Use anything to file your money; envelopes, cash bags, jars, different sections of your wallet, separate bank accounts. Anywhere, just file it away so you don’t spend it until it’s needed.

If you’re adamant you don’t want to handle cash, another way to file your money is to open many bank accounts. You can never have too many (I have 8 + a Raiz account). When you’re paid, transfer your allocated amounts to each account then watch them grow over the weeks or months and spend from these as needed or when you’ve reached your target.

Extra bank accounts may be needed if you’re filing large amounts of cash anyway. Once you’ve built up a certain amount at home you will need to put it somewhere safer after you’ve got the feel and momentum of intentionally saving it.

Filing your money to the areas of spending you value will never disrupt your household expenses meaning this system gets you ahead instead of running out of money or slipping behind.

The only way to control where your money goes is to control it. If you don’t control your money it will eventually control you.

Write a comment