Following on from the previous article How $100 a week will improve your life, I’m sharing my saving plans, how I divide my $100 to see the most benefit and the results I’m expecting from each plan. I'm sharing this information to show you that even when you’re living on a low income like I am, it’s still possible to save money within your budget that will help you actually achieve more than one savings goal.

I have tightened up my budget to allow me to do this on a single income and if I can do it, I’m sure you can find $100 to achieve some goals too. I have a few savings areas on the go at the same time. I divide it up to add to each goal every time I'm paid. I'm saving up for a new Hot Water System (ours is on the way out at 10 years of age) and also a holiday. Even though I only have 2 goals currently, I divide my $100 into 4 areas because other things usually pop up by the end of the year, like school expenses or even just to cover Christmas expenses and presents.

I love dividing up a set amount each time I’m paid. It puts a bit of fun into my pay and I think it’s my way of 'spending' without actually spending. I get satisfaction from allocating it to each of my savings goals and watching them gain momentum watching the balances grow. Because I haven’t had a lot to spend on myself over the years, I’ve found the spending ‘hit’ in something else that benefits me and my family.

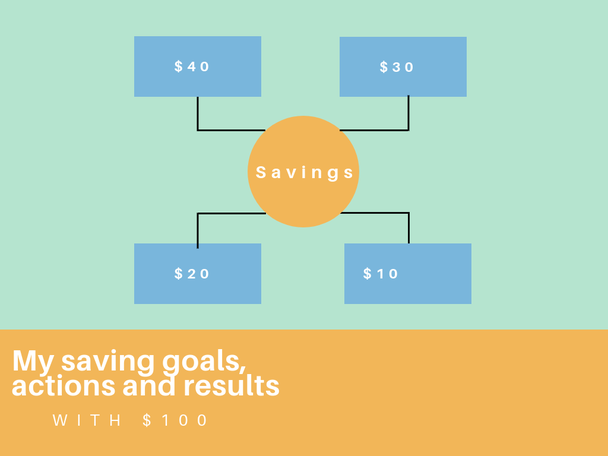

I divide my $100 into 4 amounts: $40, $30, $20 and $10.

The $40 I transfer to a savings account for the stupid Hot Water System (yes I’m bitter that I need to spend over $2000 on this, ha!) $30 goes towards a holiday and this is put into another savings account to keep them separate and know the balance of each. The $20 is added to my emergency fund knowing that this amount alone will be an extra $1040 in 1 year. If I don’t need it for anything at the end of the year I’ll leave it in my emergency fund because I will always need more in here as the years roll by. Finally the $10 is automatically sent to my RAIZ micro investment app to slowly add up over the year.

Separate to my $100 savings amount, I also save any $2 coins I end up with through the week into a 750ml water bottle. This is a bit of a novelty savings idea but works! It can take a bit longer than a year to reach the top of the bottle but a 750ml bottle holds just over $1000 in $2 coins which will complete another small goal I will come up with as it gets close to the top. (Currently it will be used for next Christmas)

I also have 3 ‘cash back’ apps on my phone for the times I have to purchase something online. These work for me as another savings tool slowly adding up in the back ground. Some purchases give me 30% cash back. A third of the purchase price! They’re definitely something to think about having and using to your advantage. In a couple of years I hope to have a few hundred dollars. This will be more than enough for an airfare somewhere, cutting the cost of that holiday down by about a third.

I’ve always hoped that I could set things up to earn money in different ways while doing very little for it. I knew US residents had cash back apps available and other avenues to earn small amounts of money although Australia did not. Some in the US only required you to only scan your grocery receipts to be rewarded. The online surveys were never for me though. Signing up to a few surveys somehow turned my email into a dumping ground for other companies to bombard me with their marketing. No thanks. I’m a big fan of keeping it simple and making things easier to remember.

It took a few decades to finally reach Australia but now they’re becoming available to us Aussies. I saw the benefits straight away with lots of small amounts adding up, The return on investment is good which is what we all want. (in this case the investment is not money, but small amounts of effort). Mini multiple streams of money I call them. I love them because they allow me to do more with my low income life by providing me a little bonus every year or two.

I use the RAIZ REWARDS feature in my Raiz micro investing App, SHOP BACK APP and

TAKE MONEY WHERE EVER YOU CAN EARN IT.

THE MORE SMALL SAVING STREAMS YOU HAVE,

THE MORE BONUS MONEY YOU WILL HAVE TO USE.

By having more than one savings plan, you're more likely to achieve things rather than not getting anywhere. Spread your savings and get more out of life by crossing things off your list.

MY SAVINGS IN LIST FORM:

My $100 split 40/30/20/10 each time I'm paid:

$40 Hot Water System for when my current one dies =$2080

$30 Holiday Fund for my next holiday sometime next year =$1560

$20 Emergency Fund adding to fund for unexpected moments =$1040

$10 RAIZ App auto payments ($10 each pay) from pay account =$520

Not including these 2 extra savings:

750ml Water bottle that I dump all of my $2 coins into =$1000

3 Cash Back Apps slowly adding up when I make online purchases =$200

All of these combined amounts will reserve me a total of $6,400 in 1 year to do what I need to, moving forward towards more goals!

How many goals could you achieve after just 1 patient but fast year?

Set yourself some goals, put them into action and get results.

Sign up below to receive 9 free printable pdf

including more easy ways I sometimes save money :)

Write a comment