Paying off your mortgage in the fastest time possible will save you thousands of dollars and years off the life of your loan. This allows you to have extra money to invest somewhere else, maybe another house to earn you future income with rent you make? Or maybe you'd just like to be able to enjoy life a bit more by taking holidays and having more freedom to do so.

Become aware of how your home loan works and how you can pay it off sooner. By using all, some or even just one of these hacks you will be closer to owning your home sooner than you currently are. The longer the life of the loan, the more interest you will pay to your lender and that is far better spent on a second investment property as mentioned above.

Are you able to add any of these to your mortgage repayment system?

1.

The most important thing for a successful budget is to not spend more than 30% of your income on your minimum mortgage repayment. This is because you need to be able to repay the loan and also pay for your other costs of living. It's safer in case your income drops for some reason, or if one half of a couple is not working for some time and really if it's anymore than 30% of your total income, you're paying too much for housing. If you're repaying more than 30% you might need to look at increasing your income somehow but don't forget, if you spend more than 30% of your income (joint income if a couple) on housing, other areas of your budget and lifestyle will suffer, especially if living on a low income.

2.

Know and understand that you don’t actually own your home until you’ve paid off the mortgage on the property. Until then, it’s actually a liability for you. A lot of people think their bank owned home is an asset but it’s not. This knowledge can be easy motivation to want to pay it off sooner and turn that around. When you do own one house, you’re able to create an income to pay another house off or as income to enable you to work less with some passive income from rentals, if not right now but in the future when you'll want to work less. When you own your home and it is capable of making you money, it is then an asset.

3.

When your very first repayment is due on a new mortgage, try to pay one double repayment or any extra if possible before the first actual repayment is due. Not only will you be ahead a few repayments as back up but you’ll be instantly paying less interest and more off the capital. The lenders calculate interest daily but it is charged once or a few times a month so any extra you pay will reduce the interest which is calculated on the lower principal amount. Paying a few repayments in advance is a great trick to be ahead and for instantly lowering the amount of interest charged. Over time, even a small extra amount will save you a lot of wasted interest paid to your lender and more from the principal borrowed amount.

If you're a couple with 2 cars, or even 3, are you able to sell one and use this money against your mortgage by lowering the balance owed and the interest charged? As this amount is an ‘extra repayment’, if desperately needed to use this amount in the future you’re able to redraw it. Even temporary extra money you have is better sitting on (or coming off) the amount owed on your home to reduce interest charged.

4.

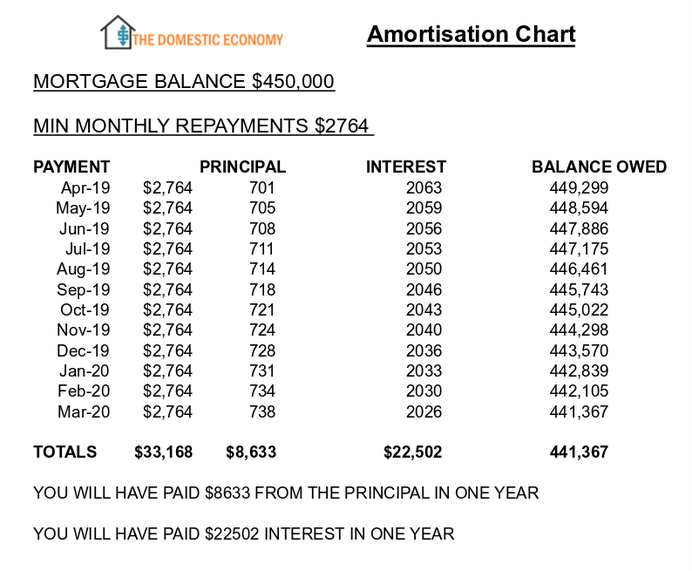

An easy Amortisation chart can show you the way your mortgage works and will benefit you and the way you repay it. By understanding it, you can manage it better. Most mortgages are principal and interest loans and this chart will show you the portion of interest and principal amount you are actually paying each month if you have a fixed loan with amounts fixed instead of varying. It's the best way to see how mortgages work and to understand amounts you are actually paying off the balance with each repayment.

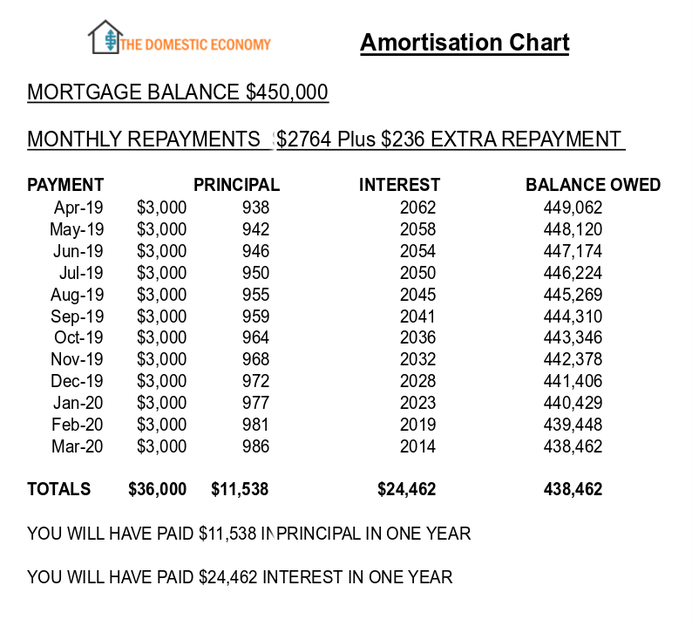

By paying more than the minimum repayment each month, you will naturally reduce the principal of the loan a bit more than you would if only paying minimum repayments all year.

HOW IT WORKS

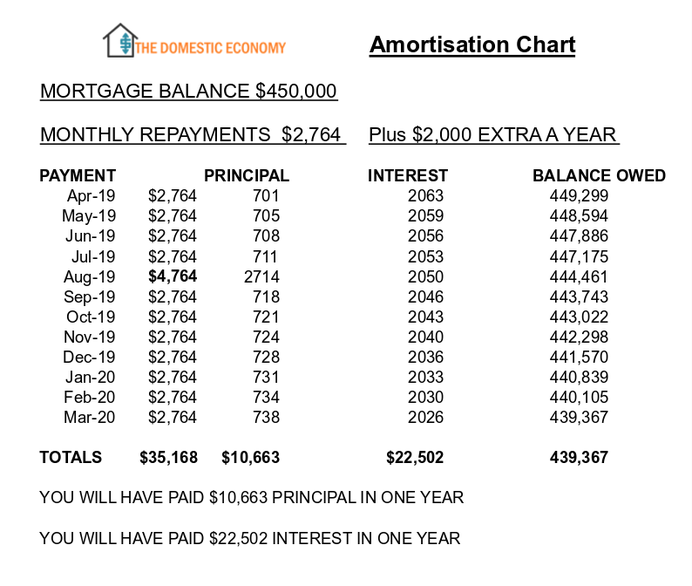

These payment examples are based on the same mortgage of $450,000 , paid monthly over 25 years making only the minimum repayments to compare payment systems. Don't just wave your eyes over the numbers. By actually 'reading' each chart you will understand exactly how your mortgage works and see that by adding extra payments you reduce the principal of the loan. Don't forget, all 'extra' money paid to your mortgage reduces the principal balance, therefore reducing the interest charged on the next repayment and paying the damned thing off faster :)

I wish I had written out my own amortisation chart to follow from the beginning of my mortgage. It would have motivated me to lower it faster when I could... I will be following a chart in the future for my next mortgage.

The first chart shows repayments on the mortgage, for the first year. It explains how your repayments are spread over the principal of the loan and the interest charged, giving you a real balance as you make payments (approx 300 repayments for a loan of this size is how long it will take to repay).

The chart below explains with an example of much faster principal reduction just by paying a little more each month, and rounding up to the nearest thousand, for example.

The 3rd chart below shows you the result of paying one extra $2,000 payment each year. Reducing the life of the loan by paying one lump sum on principal once a year might be a more achievable way to pay your mortgage off sooner. It will reduce the interest paid each repayment there after by a noticeable amount.

5.

If you’re a couple earning two incomes, try to live off one for a short (or longer) amount of time. If nothing else it’s great practice for when any babies come into the house and you’re living on just one income. If you can, use one entire income for mortgage repayments. Doing this for as little as a few months each year, will save you thousands in interest over the life of the loan. Even if you’re unable to make extra repayments because your mortgage is in a ‘fixed term’, you can keep extra amounts aside in a separate bank account to make a lump sum repayment once or twice a year. This will depend on the terms and conditions of your mortgage regarding extra repayments.

6.

Cut back all of your household expenses, anywhere you can and use the savings to pay more off your home loan. I can’t mention this way to save money enough. It’s the easiest way to pay less on wasted areas and to use on more practical payments. Free up more of your income to allocate it to your mortgage and lower the balance faster. Sacrifice a little effort now to benefit sooner.

7.

Can you rent out part of your home to help make repayments before deciding to have your own kids? House share for extra repayments on your home loan. You really only need to do this for a short time to contribute more and get the mortgage down. If done for many years, you’ll be able to get a lot more paid off. If you live in a state other than Victoria, you're able to have a bungalow in your backyard to rent out. This will not only increase your mortgage repayments but will also increase the value of the property when time to sell and move on.

8.

Start debt free. Before even entering into a home loan contract, pay off all other debt first. You’ll need as much income as possible to comfortably pay off the loan. Try to avoid more debt once repaying a mortgage until you’ve had a few good years to concentrate on getting the amount owed a good chunk lower. If you are paying off a mortgage and paying off student loans or credit card debt as well, there won’t be much left for other living expenses or even fun. Bad debt will rob you of the lifestyle you want. You’ll be stuck paying only minimum repayments and not being able to lower your mortgage in the early years as a priority.

9.

Go without some things in life now, to be able to afford more later. This is good advice for people in their 20’s buying their first home. If you do this while young, you’ll own your first home sooner and will be able to buy more assets to give you an income and work less as you get older. If you want the best of both, stay within your means, follow a budget and you just may be able to pay off a home loan, socialise a little and afford to eat :)

10.

If you’re lucky enough to have been in your house for a few years it will have gained value and therefore equity. This equity can be used for borrowing power for a second mortgage on another property. Rent out the second house and get some tenants to pay off the mortgage. In 15-20 years you’ll own the rental property and will start earning an income from the rent when you need it as getting older. While your tenants are paying off your mortgage and interest charged you can continue to pay your own mortgage at the same time as setting up your future. There’s never a shortage of people wanting to rent a house so it’s a safe investment.

Any of these mortgage hacks will allow you to pay off your home sooner to set yourself up with an asset. Who wouldn’t like to save tens of thousands of dollars, own their home sooner and free up income to give you a better lifestyle?

Comment below if you have any more home loan hacks you use to reduce your mortgage faster!

Write a comment