?

10 Signs we need a budget system for our money…

Many people don’t follow a budget for fear of restriction but a budget does not cause this to happen. If worried about restriction, there’s more at play because a budget should allow us to get everything we need and want!

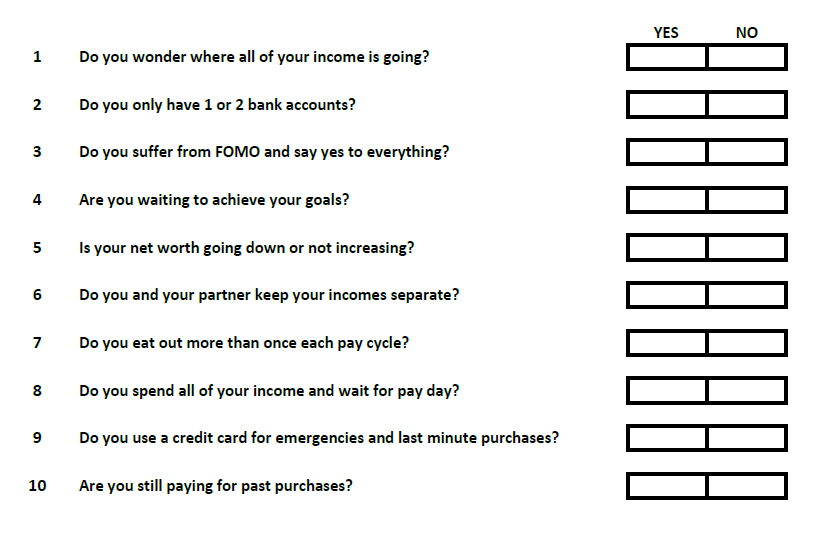

There are certain indicators that tell us we need to try something different to avoid staying where we are. How many of the following affect you and your household money management system? If you say YES to any of these find out why a money system change would be beneficial in that area.

QUICK QUESTIONAIRE

These 10 indicators tell us how a budget system benefits and allows.

1. INCOME LEAKS

When following a budget, you know exactly where your income goes because you allocate it and tell it what to do before it leaves.

2. BANK ACCOUNTS

Budgets provide an allocation list to different spending areas keeping it all separate. This requires multiple places to store it. Otherwise, you don’t have a clear vision of spending amounts or how your goals are performing.

3. FOMO & DOING EVERYTHING

A budget tells you when you’re suffering from FOMO and if you can do so. If always falling short due to fun and spending on activities it tells you that you can’t do everything and if you continue to do so other areas will suffer.

4. ACHIEVING GOALS

A budget will direct money toward your goals. It avoids the need to take on debt to achieve your goals by preparing for the purchase without the risk and extra costs involved. Using debt to achieve something instantly can linger on for years which stops other goals from being achieved.

5. NET WORTH

When you’re aware of your net worth, you can see exactly where you need to improve. Being in the know, helps you stay accountable to your budget by wanting to increase your net worth over time and for the future.

6. SEPARATING INCOMES

A household budget points out that combining lives requires combining income for the life you share and work toward as a couple. This can be an alert indicator that there may be more going on in the relationship because you’re not working together and share everything but the money. If not combining income for the household and each other, you should question why you might not be working toward the same thing in life, retirement and the legacy you want to create together.

7. EATING OUT

A budget can allow you to eat out often but it will also tell you if you can afford to do this often. Eating out is a major money leak and should be monitored to ensure your money is also doing everything else you need to live and grow wealth.

8. SPENDING THE LOT

A budget is only a list that tells you where to allocate all of your income and we should be allocating ALL of it, not spending all of it. If paying for things without following the list you are more likely to believe your goals are unachievable, avoid planning for the future and keep spending as you want.

9. USING CREDIT CARDS

When following a budget you’re able to prepare for emergencies AND provide for impulse purchases without the need for a credit card. Having as little as a $1000 emergency fund will allow you to pay for most household emergencies as they tend to be whitegoods repair or replacement, car repairs or health related costs (personal and pets). Use your own money to purchase items online using a debit card instead of a credit card.

10. HAVING REPAYMENTS

Budgets stop you from having to pay for past purchases because each pay you are adding to your spending and goal areas in advance. If impulse purchases are the reason you don’t budget, create an impulse spending fund to pay for last minute decisions to spend money outside your budget.

Have you discovered a need or want to get your money under control instead of living week to week?

Head to my START HERE page to get started :)

Write a comment