I not only look at the price of something at the time of purchase. I’m a tad weird and I’m sure I’m not the only one who does this, but I look at a purchase or expense in a little more depth. I’m definitely a money nerd, obsessed with how to stretch a dollar and get the most from my income.

I think about not only the purchase price but how much it will cost me for the life of the item. I think about the percentage of income it will take from me (how dare they do that!) and the time I had to work to pay for it.

The main thing I do when making a purchase or deciding on an expense amount is to get the total yearly amount I will be paying. Incomes are looked at as a total annual amount so by thinking about how much of this will be used for expenses you can get a good idea of where the bulk of your money goes.

So if looking at my regular expense of fuel I have my regular fuel total of $60 each fortnight. I then multiply this by the amount of pays I’m paid each year to get an annual amount of $1,560 After picking your face up from the floor you can start to see how much life costs. This means I worked for 2 weeks of the year just to cover the cost of my fuel!

This could then lead you into the thought of the whole cost of running your car. How much does that cost you? For an example, my yearly car costs are $7670 and this is a low average cost.

Car Loan $3240

Fuel $1560

Rego $650

Insurance $ 720

Services $1500

TOTAL $7670

That's for car expenses only, not even for vital living expenses! …please tell your kids this information so they’re aware.

Groceries are another eye opener. Multiply your average grocery amount x the amount of grocery days you will have. My fortnightly example is $400 x 26 = $10,400 I spend each year on groceries. That’s a lot of money for just one household

expense!!

This is a great exercise to do, to see how much you actually spend and easily see what percentage of your income you spend in each area of your lifestyle. You should find your total amounts for every cost you have.

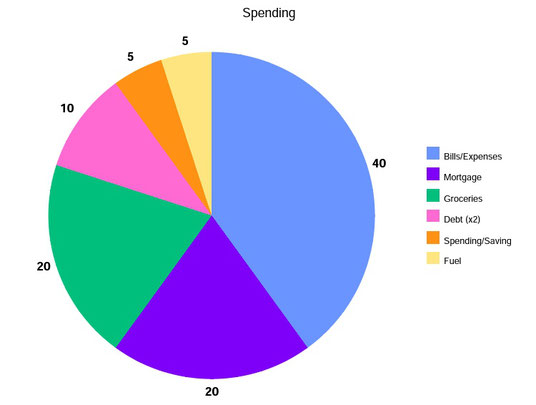

After finding a total amount for each one it will help you become more aware of your earnings and spending and you can see exactly where the bulk of your money goes each year. You will know if and how much income left over after expenses are taken out and this can make goals and planning more fun and easy to achieve. If any amounts are too extreme, I can then look at each one separately to see if any savings can be made by lowering my expenses. Knowing your yearly amounts (or at least having them written down somewhere as a reference) you’re able to see what percentage of income is spent where. Draw up your own rough pie chart to see it clearly.

Mine roughly looks like this

Mortgage $10,600

Groceries $10,400

Fuel $1,560

Personal spending/saving $3,900

Kids pocket money $2,340

All other bills $20,000

DEBTS: Car loan & Braces $6,000

TOTAL NEEDED FOR THE YEAR $54,800

Looking at the amounts I spend,

*I now know how much money I need to be earning each year.

*How much of my annual income I need to use and what it is for. Knowing how much I need to live on each year makes incoming and outgoing money easy to manage.

* I can see that my bills and expenses each year is where it’s costing me the most to live.

*I can then see where I need to cut back by reducing or getting rid of some expenses.

*I know how much income I have left over after expenses for other purposes and can make plans for it each year. Whether this is for more savings, investing or using for home maintenance or even a holiday, you can see exactly how much you have

left over if any to ‘play with’.

Any bills paid only once a year are still good to total up. Insurance for example, is not a cost to be cut but still good to know what it costs you to protect yourself against hardship, accidents and damages. Add all insurances up to see what you’re paying.

Open the calculator app on your phone and do a few basic sums with some of your expenses. How much does your Mortgage cost you for one year? What about groceries, how much do you spend a year on food at home? Do you know how much your quarterly electricity bill is? Easily multiply this by 4 to find a total annual amount. How much do you pay for your mobile phone plan for the year? Can you change plans to lower a bill (or more if paying for more than one plan in the household)?

By dissecting your budget to look at each expense one by one, you’ll have a better understanding of who gets your money each year and how much they take from you. Hopefully it will give you a different perspective which will lead to watching

your spending a little closer to save. Why should companies get so much of your income every year??

Go through your expenses as little or as much as you want to and you’ll get a better picture of the amounts you earn, spend and have left over. This is what I do to make managing my money so easy. Mastering your money doesn’t have to be hard or time consuming. Look after it little and often and you’ll find everything stays fresh in your mind making it all simple. Most households don’t have that many expenses to keep track of which also makes it easy. Write down all expenses in order of being due and cross them off as you pay them.

Write a comment