My products & services

eBooks & interactive budgeting tools

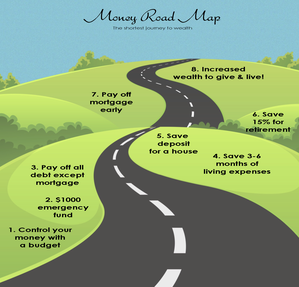

Free Money Road Map; journey to wealth

Free quick read download explaining the personal finance steps to increase wealth & the reasons why the order makes it work.

PDF (3pg) to start the fool proof money plan.

Free Compound Calculator

Download your personal compound calculator to see how compound interest works to snowball our savings and retirement money over the years. It causes us to start thinking of our possibilities when we see how interest is earned instead of paid.

(Excel File)

Free 7 Day Mindful Money Challenge

I have a challenge for you. Sign up to the free 7 day challenge & get your free 30pg eBook delivered straight to your inbox.

If you've been ignoring your financial situation this challenge will reconnect you with your money to spot any areas that need improving. 7 days of mindful action in this 30pg fillable eBook to save or print.

Free 30k by 30 eBook

How to retire with 1 million dollars

by reaching 30k in retirement by the age of 30!

Best learned in our teens or 20's but beneficial to know at any age... Seeing different outcomes brings awareness & allows us to make decisions through life according to our desired outcome.

Your retirement number is possible when you see how compound interest works for you!

Budget Toolkit

Simplify your money management with these handy tools in one file.

If you've tried to follow a budget before but found it hard to manage, the BASIC BUDGET TOOLKIT is where you can create & monitor your weekly budget to stay on track.

Add your numbers on each page and it will calculate your household income, weekly expenses and the bills that come in irregularly. Save your Toolkit file for quick access to monitor just like an App. Instructions included.

Progress Tools

9 files to download and use for paying off debt, calculating savings possibilities and planning ahead to be ready with money.

Financial Coaching

FRAME YOUR FINANCES TO WORK FOR YOU.

My mission is not to charge clients for my time alone but to provide a valuable service and charge based on the value YOU will find in our session/s together.

1:1 coaching:

via Zoom or phone call

FIRST -

A free 15 minute Q&A phone call to discover if my services fit for your needs.

******

Choice of;

A single DISCOVERY Session (approx. 90mins) where we work together to create your new easy budget system & where to start.

Your investment of $90 includes,

- Build your simple budget System

- The Money Road Map to wealth

- Discover opportunities & options

- Staying on track

- Fillable PDF files of everything covered

- FREE Budget Toolkit

******

6 x sessions, EUREKA Package

3 Month Coaching Package (fortnightly meetings), working together to change money handling habits to create wealth & live the life you want by achieving your goals. Delivering financial empowerment and transformation.

Your investment of $585 includes,

- Build your simple budget system

- Why we handle money the way we do (+ couples unite)

- Overcoming financial overwhelm

- Eliminating debt

- Goal planning

- Safe housing foundations

- Mortgage reduction & Superannuation growth

- Increasing & protecting wealth

- A complete money journey to wealth plan

******

On-going check-in

Post coaching sessions (if required).

A 30 minute check-in to remain focused on your finances or ask any questions.

I avoid the system that keeps us in debt & help people do the same to achieve their best life. By following principles & procedures to increase wealth, it safely propels us forward instead of relying on debt, financial policies & investments. How much money would you have to invest if you first got your money on track?

If I was a financial counsellor I would be helping people in an income crisis while referring clients to certain organizations to help them through their surrounding issues. That’s not my area although studying this field to gain qualification.

If I was a financial adviser or planner I would be helping people invest their money to give them a good rate of return by selling policy products & services. I’m not selling any financial products or services & do not receive commissions from these.

I’m a financial coach & I offer strategy options and mathematically proven ways to stay out of debt, control your money, protect your household while growing net worth… so you’re able to move on & work with an investment professional.

Most people earn enough money but weren’t taught ways to increase their wealth safely while dealing with day to day spending...

Debt has become relied on as a result & a normal way to get what we want in life without really growing wealth...

Overwhelm is felt due to our lives being so busy trying to earn enough money to cover spending...

But I can show you simple procedures to grow wealth safely using your income & common sense ways to protect yourself now & safely into retirement AND how to get everything you want in life & old age, empowering you to take action to achieve this.

© Copyright 2024 The Domestic Economy